It’s everyone’s favorite time of year. The 1099-MISC forms start rolling in, you start pouring over receipts to find deductions, and inevitably you get a huge headache from doing your taxes. Let’s help each other out this year and share some tips that we’ve all found. We’ll start by listing some things we know and use and then everyone can add tips to the comments. The best tips will get added to this article.

Disclaimer: Nerdy DJ and its employees are not certified tax preparation agents and all advice given should not be taken as official and/or legal advice. These tips are intended as informal suggestions. Please consult a certified CPA for any questions you may have. We take no responsibility for misuse of the contents herein.

Apps To Make Tax Time Easier

- Shoeboxed – we mentioned this one before, but figured it was worth another mention. Shoeboxed lets you digitize your receipts and categorizes them automatically so when it’s tax time all of your deductions are in one place, already sorted out for you.

- TurboTax – If you want to do your taxes yourself, Turbotax makes it relatively easy and will walk you through everything you can and can’t deduct.

- Milebug – Keep track of your mileage to and from gigs!

- Evernote – Evernote is a great alternative if you just want to take notes and keep track of your income and expenses (although we recommend having a proper ledger, see below)

Keep Track Of Your Deductions

There are tons of things you can deduct including mileage to and from your gig, meals, control records, music that you purchase, etc . You’ll need receipts for pretty much everything which will serve as a record for the IRS. Your CPA may request these from you (if you use a CPA) so make sure you have them handy. Again, we point to the aforementioned Shoeboxed as a solution to keep everything in order. In addition to keeping track of your deductions, it’s important to keep track of pretty much everything, which brings us to our next point:

Keep A Record Of Income and Expenses

You should be using some sort of system to track your DJ income as well as your expenses. The biggest reason is you need an accurate record of all the money you made. I can’t stress how important this is especially when it’s tax time. There have been several times that a venue/company never sent ME a 1099 but sent it to the IRS. Luckily I keep track of everything so I know what to report on my tax return. This also comes in handy when you get a 1099 stating the club paid you more than they actually did (also happened).

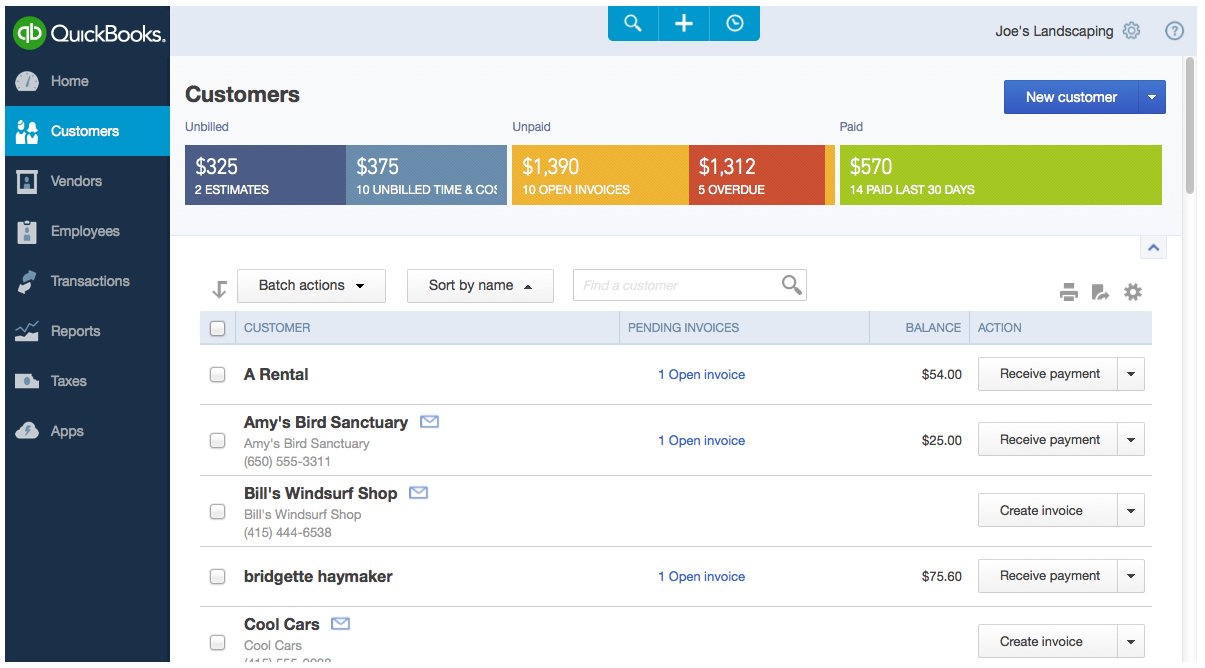

There are several software products that can help you out in this area. I’ve recently started using Outright (now called Online Bookkeeping by GoDaddy) because it makes this so much easier. In fact, it ties into Shoeboxed and automatically adds my expenses for me. I can then share this with a CPA, but as a bonus it tells me how much I should expect to pay in taxes each quarter. As an added bonus they just added invoicing so now I don’t need a separate solution for that. You could always just keep an excel spreadsheet handy as well. There also other online solutions like Quickbooks (owned by the same company that owns TurboTax, so integration should be easy), Wave, and Xero.

Keep A Separate Bank Account For Your DJ Income

One of the best things you can do to make keeping track of things easier come tax time is to have a separate bank account just for your DJ income. If you ever get audited it may make things much easier and quicker. Besides, do you really want someone auditing your regular bank account and noticing how many times per week you eat at the diner after DJing?

Chances are your bank offers business bank accounts (unless you use a credit union) and you’ll be able to transfer money from your DJ account to your personal account. This will obviously vary by bank, but is something you should look in to.

What Are Your Tax Tips For DJs?

As we said before, we’re not really experts and are looking for help in this area as well. If you have any tips or suggestions that weren’t mentioned please let us know below!